The UK is renowned for its diverse landscapes, from rugged coastlines and rolling hills to lush forests and tranquil lakes, showcasing natural beauty that captivates visitors and residents alike. Transparency and accountability are paramount in the global financial landscape. To achieve this, various regulatory measures have been implemented, one of which is the Legal Entity Identifier. The process of LEI registration UK encompasses multiple stages aimed at guaranteeing adherence to regulatory standards.

Step 1: Determine the Need for a Legal Entity Identifier

Before initiating the registration process, entities must assess whether they require a legal entity identifier. Generally, entities engaged in financial transactions, such as corporations, banks, investment funds, and trusts, must obtain this. Entities can consult regulatory guidelines or seek advice from financial professionals to determine their requirements.

Step 2: Select an Accredited LEI Issuer

Once an LEI is needed, entities must choose an accredited issuer to facilitate registration. These issuers are authorised entities responsible for assigning LEIs in compliance with regulatory standards. Entities can select an issuer based on reputation, pricing, and service quality.

Step 3: Gather the Required Information

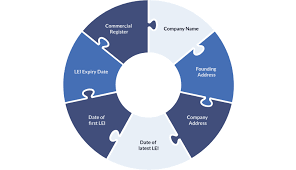

Before applying, entities must gather the necessary information for registration. This typically includes the legal entity’s name, registered address, organisational structure, and ownership information. Ensuring the accuracy and completeness of the information is crucial to expediting the registration process and avoiding potential delays or rejections.

Step 4: Submit Application

With the information gathered, entities can submit their application through the chosen online platform or designated channels. During the application process, entities may need to provide additional documentation or clarification to support their application. Reviewing the application thoroughly before submission is essential to minimise errors or discrepancies.

Step 5: Verification and Validation

Once the application is submitted, the accredited LEI issuer will verify the provided information and validate the entity’s eligibility. This process may involve conducting due diligence checks to ensure compliance with regulatory requirements and the accuracy of the information provided. Entities should cooperate with the issuer and promptly respond to additional information or documentation requests.

Step 6: Issuance of LEI

Upon successful verification and validation, the accredited issuer will assign an entity an LEI. This will be generated and registered in the Global Legal Entity Identifier System (GLEIS), making it accessible to regulatory authorities and market participants worldwide. Entities will receive their LEI certificate confirming the issuance of the legal entity identifier.

Step 7: Maintain and Renew LEI

Obtaining a legal entity identifier is a time-consuming process. Entities must maintain and renew this annually to ensure its validity and compliance. Accredited issuers typically provide maintenance and renewal services, including reminders and assistance in updating entity information or renewing registrations.

The LEI registration in the UK is a structured and essential procedure to enhance transparency and accountability in financial markets. By obtaining an LEI, entities demonstrate their commitment to regulatory compliance and facilitate efficient identification and tracking of their activities. Understanding the steps involved in the registration process is crucial for entities seeking to comply with regulatory requirements and operate seamlessly within the financial ecosystem.